Blog Post by Yari

December 1st, 2025

I’ve finally been released from my NDA, I might know an unhealthy amount of Semiconductor operations and RCA (which legally, I can’t disclose but it did take a significant amount of my time). There will be a Yariverse episode and article about how to deal with a team that would make the interview question easy to answer “Have you ever dealt with a difficult person/team to work with?”

AI Bubble vs. The Housing Crisis

In 2008, you didn’t need to be on Wall Street to sense the eeriness in the air. You could feel it, like Pennywise stalking the suburbs, tension crawling across dinner tables and the visible lack of red balloons. I don’t think I ever noticed sewers as much as I did that year. The housing crisis wasn’t just an economic cannon event that put Michael Burry on the map for betting correctly it was a financial rapture. And now, as chatter around an “AI bubble” grows louder and wider, many wonder if another bubble is about to pop.

In girl code: Your bestie is out of the honeymoon phase and things are about to go off, this is her third and final crash out. The questions is which little thing will set off the argument you’ll get to hear about at Brunch?

With the Housing Crisis:

- The raw materials were finite: land, buildings, mortgages, tangible and visible. When speculation outran underlying fundamentals, the floor snapped, and you could literally see that floor (imagine the Strangers Things crew repo dismantling Tina’s house to take out the Demigorgan).

With AI:

- The raw material is intelligence: model weights, GPUs, compute capacity, and wherever “the cloud” is located in it’s infinite yet scarce details, abundant yet expensive, and heavily hoarded behind NDAs and carefully place data storage facilities.

The AI boom isn’t about a chatbot writing poetry or the cooling water crisis required to keep servers from overheating. It’s about capital reallocation around the belief that intelligence can be manufactured, that it can replace human labor. But the true bubble risk isn’t the existence of the tech; it’s the velocity of its expectation. Investors aren’t betting on what AI is, they’re betting on what it could be. A venture capital gamble. And that’s where the comparison to 2008 gets interesting.

Both bubbles were fueled by narratives of inevitability:

- Housing myth: “Real estate always goes up (even in undesirable locations).”

- AI myth: “AGI is inevitable: bet early or get left behind.” (It’s why everyone is investing despite low returns and also why some companies have started to rehire talent)

Both were fueled by cheap capital & labor reduction:

- Housing: subprime mortgages in the early 2000s

- AI: zero interest rates and VC pressure to deploy funds before someone else takes the lead

Both mispriced risk:

- Housing: mortgage default risk

- AI: commercialization risk, the gap between breakthroughs and profitable implementation

But here’s the critical difference:

- Housing collapsed because the financial machinery was fragile.

- AI is built on increasing returns. Models get cheaper to train as they scale -> GPUs get more efficient each generation – > Data compounds

AI doesn’t need infinite demand to sustain itself according to a new study it grows stronger simply by being used. “The perfect employee. Never tired. Always outputting.” Or so the promise says. Still, bubbles burst not because something isn’t valuable, but because expectations detach from reality.

Here’s the Yariverse truth: AI’s scientific foundation is real, but the valuations layered on top? Fantasies built on compute concentration.

The risk isn’t collapse. It’s consolidation.

A few “Seven Big Dog” companies could capture all the economic asymmetry, create the illusion of endless funding, a deleterious artificial multistage codependent cycle. While the housing collapse was a story of debt a tale as old as time. The AI wave will either widen opportunity (if you can navigate it correctly) or compress it (if it’s used improperly).

In short, the bubble gets bigger, or it pops.

And unlike 2008, this time we aren’t spectators to our parents’ mistakes. We’re in the system: builders, critics, contributors. Whether AI becomes a bubble or a megacycle depends on what we choose to build next and what gets funded.

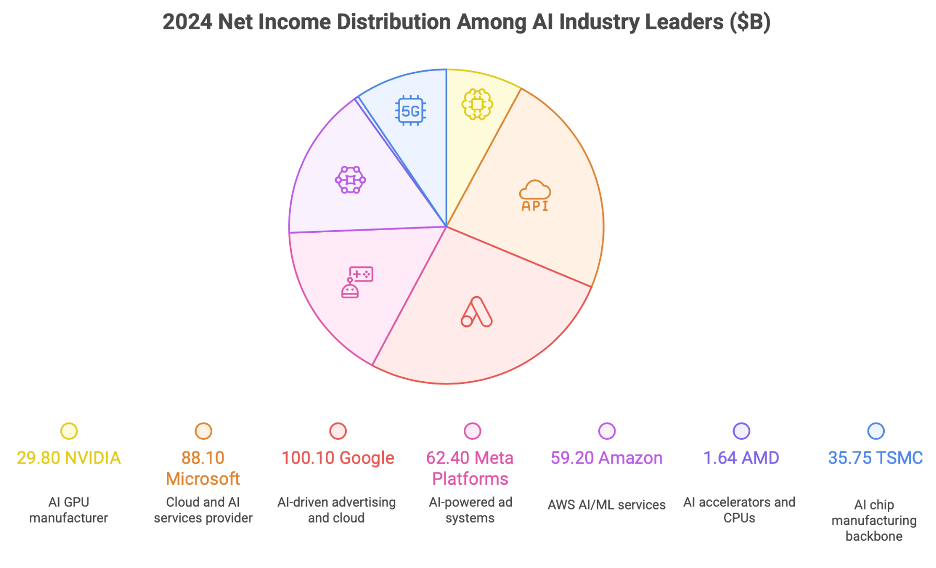

Here’s the 7 Big Dogs in the AI Bubble (and their dog breeds):

NVIDIA (NVDA)

- Trading with: Microsoft, Amazon, Google, Meta, Tesla (everyone buying GPUs for AI workloads)

- Profit: approx. $29.8B net income in 2024, up 580% YoY

- Dog Type: Border Collie: hyper intelligent, elite performance, if it blinks there will be cute photo ops and someone rushing to buy in the product it sniffed

Microsoft (MSFT)

- Trading with: Azure AI customers and OpenAI partnership licensing/infrastructure

- Profit: approx. $88.1B net income in 2024, driven by AI powered cloud and productivity tools

- Dog Type: Golden Retriever: stable, dependable, globally trusted, a bit goofy

Alphabet (GOOG) / Google (GOOGL)

- Trading with: Advertisers and Google Cloud AI clients across industries

- Profit: approx. $100.1B net income in 2024, boosted by AI ad efficiency

- Dog Type: German Shepherd: strategic, precise, dominant, trainable if you have the right referral

Meta (META)

- Trading with: Advertisers using AI targeting/recommendation systems

- Profit: approx. $62.4B net income in 2024, strong AI driven margins

- Dog Type: Siberian Husky: loud, chaotic, powerful, built for scale but don’t leave it to itself too long

Amazon (AMZN)

- Trading with: AWS AI/ML clients + retail/logistics optimization

- Profit: approx. $59.2B net income in 2024, nearly doubled YoY

- Dog Type: Labrador Retriever: friendly, efficient, unstoppable engine, if it doesn’t show the doggie care will suffer loss of happiness

AMD

- Trading with: Cloud providers buying EPYC CPUs and AI accelerators

- Profit: approx. $1.64B net income in 2024, up 92% YoY

- Dog Type: Australian Shepherd: agile, clever underdog competitor, you won’t notice it until it’s herding you in

TSMC (TSM)

- Trading with: Manufacturing backbone for Nvidia, Apple, AMD

- Profit: approx. $36.5B net income (2024), driven by advanced AI chip nodes

- Dog Type: Great Pyrenees: silent giant guarding the industry, rarely ever in the news unless there’s geopolitical tensions involved or they rescue a little French boy (the economy or in this case “Belle and Sebastian“)

So how far are we in the bubble?

Ask Pat Gelsinger, and he’ll tell you we’re already in one, but that it won’t pop for years. Analysts however differ in the following:

- Some expect a correction in the next year

- Others see continued acceleration until 2028-2030 to reach the “bubble phase” before a structural reset

But you’re just a girl: what does that mean?

Deep infrastructure (chips, data centers) will keep growing.

Hype only players? They’ll fall first.

AI is a rational bubble:

The real value is the root, overvaluation at the edges.

Like a tsunami expect:

Small waves → then one massive big wave → with more waves afterward.

The Yariverse Estimate

We’re somewhere in the middle of the boom in 2025.

Speculative failures: likely 2026 to 2027.

Mass economic infusion: 2028 to 2030, then a rebasing to fundamentals.

But if we’re honest, it might pop sooner, and if the quantum chip somehow becomes mainstream before 2030, that pop will be quick and swift.

Here’s a quick bubble signal code prediction:

#Python Code: Simple Bubble Detection (AI vs Housing)

import numpy as np

import pandas as pd

from sklearn.linear_model import LinearRegression

#Ex: Detecting bubble growth

years = np.array([1,2,3,4,5,6,7,8,9,10])

housing_index = np.array([100,110,120,140,160,200,250,310,380,450])

ai_investment = np.array([50,60,70,100,150,220,330,500,750,1100])

df = pd.DataFrame({

"years": years,

"housing": housing_index,

"ai_capital": ai_investment

})

#Fit linear model for exponential growth detection

model = LinearRegression()

model.fit(df[["years"]], np.log(df["ai_capital"]))

predicted = np.exp(model.predict(df[["years"]]))

df["Ai_prediction"] = predicted

df["Bubble_signal"] = df["ai_capital"] / df["predicted_ai"]

print(df)

#Bubble_signal > 1 = bubble behavior detected.

#Expected Output:

years housing Ai_capital Ai_Prediction Bubble_signal

0 1 100 50 39.369147 1.270030

1 2 110 60 56.392992 1.063962

2 3 120 70 80.778219 0.866570

3 4 140 100 115.708006 0.864244

4 5 160 150 165.741989 0.905021

5 6 200 220 237.411461 0.926661

6 7 250 330 340.071953 0.970383

7 8 310 500 487.124475 1.026432

8 9 380 750 697.764846 1.074861

9 10 450 1100 999.489464 1.100562